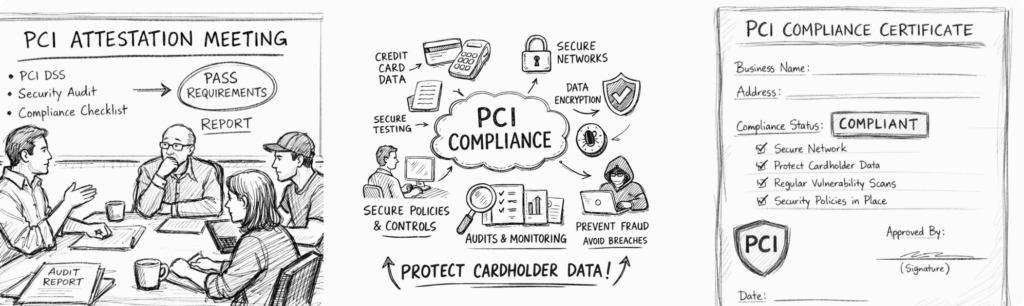

What is PCI compliance?

PCI compliance refers to adhering to the Payment Card Industry Data Security Standard (PCI DSS), which is a set of security standards designed to protect cardholder data during credit card transactions. It ensures that businesses handling cardholder information maintain a secure environment to prevent data breaches and fraud.

Who needs to be PCI compliant?

Any business that accepts credit card payments, stores, processes, or transmits cardholder data must be PCI compliant. This includes online businesses with websites that accept payments.

What are the consequences of non-compliance?

Non-compliance with PCI DSS can result in severe consequences, including fines, penalties, and even the loss of the ability to process credit card payments. In addition, non-compliant businesses are at a higher risk of data breaches and legal action from customers if their cardholder data is compromised.

Our Missions for PCI Compliance

As a tech company, safeguarding customer payment data is crucial for trust and compliance. At Gyant®, we prioritize PCI DSS compliance to ensure the security and integrity of payment transactions. By adhering to industry standards, we implement robust measures like encryption, firewalls, and access controls across our infrastructure. Our experts work to meet the rigorous PCI requirements, demonstrating our commitment to customer privacy and data protection.